TAX

ADVANTAGES

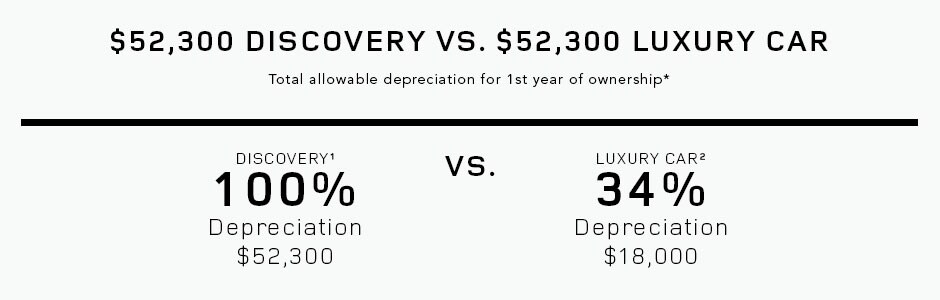

Because Range Rover, Range Rover Sport and Land Rover

Discovery have Gross Vehicle Weight Ratings (GVWR) greater than 6,000

pounds,** they can be fully depreciated in the first year of ownership

when used 100% of the time for business. That's a significant advantage

compared to a similarly priced luxury

car. TAX

DEPRECIATION COMPARISONS

The comparisons below illustrate the tax depreciation

advantages for business owners who purchase a new Range Rover, Range

Rover Sport or Land Rover Discovery before December 31, 2018.† Please

consult your tax advisor to determine how this information can be

applied to your individual business situation.

Make the most of this significant business benefit before the year is out by visiting one of our three locations.

Individual tax situations may vary. The

information presented was accurate at time of publishing. Federal rules

and tax guidelines are subject to change. Consult your tax

advisor for complete details on rules applicable to your

business.

*Comparisons based on Section 179 and 168(k) of the Internal Revenue Code, which allows for additional first year depreciation for eligible vehicles and reflects figures for owners who purchase vehicles for 100 percent business use and place vehicles in service by December 31, 2018.

1. Land Rover Discovery, Range Rover Sport and Range Rover vehicles shown fully depreciate in Year One.

2. Luxury car depreciation can continue year two at $16,000, year three at $9,600, year four at $5,760 and $1,875 per year for each succeeding year until the vehicle is fully depreciated or sold.

** With Gross Vehicle Weight Ratings (GVWR) of more than 6,000 pounds, these Land Rover models are classified as "heavy SUVs." Gross Vehicle Weight Rating (GVWR) is the manufacturer's rating of the vehicle's maximum weight when fully loaded with people and cargo.

† Comparisons based on Section 179 and 168(k) of the Internal Revenue Code, which allows for additional first year depreciation for eligible vehicles and reflects figures for owners who purchase vehicles for 100 percent business use and place vehicles in service by December 31, 2018.

*Comparisons based on Section 179 and 168(k) of the Internal Revenue Code, which allows for additional first year depreciation for eligible vehicles and reflects figures for owners who purchase vehicles for 100 percent business use and place vehicles in service by December 31, 2018.

1. Land Rover Discovery, Range Rover Sport and Range Rover vehicles shown fully depreciate in Year One.

2. Luxury car depreciation can continue year two at $16,000, year three at $9,600, year four at $5,760 and $1,875 per year for each succeeding year until the vehicle is fully depreciated or sold.

** With Gross Vehicle Weight Ratings (GVWR) of more than 6,000 pounds, these Land Rover models are classified as "heavy SUVs." Gross Vehicle Weight Rating (GVWR) is the manufacturer's rating of the vehicle's maximum weight when fully loaded with people and cargo.

† Comparisons based on Section 179 and 168(k) of the Internal Revenue Code, which allows for additional first year depreciation for eligible vehicles and reflects figures for owners who purchase vehicles for 100 percent business use and place vehicles in service by December 31, 2018.

© 2018 Jaguar Land Rover North America,

LLC.